Irrrl no credit check lenders

Another no-money-down mortgage the VA loan allows credit scores as low as 580-620. The same is true for mortgage lenders and their credit score minimums.

Louisville Kentucky Va Home Loan Mortgage Lender Louisville Kentucky Mortgage Lender For Fha Va Va Mortgage Loans Mortgage Lenders Refinance Loans

But you must be a.

. FHA Loan Refinance Credit Score Requirements. Be sure to contact more than one lender to compare. Youll go through a private bank mortgage company or credit unionnot directly through usto get an IRRRL.

Down payment The minimum down payment on a jumbo loan varies by lender. Across the spectrum of VA lending a 620 FICO score is a common credit score minimum. Check with top-rated and VA-approved lenders for your refinance.

VA IRRRL rates and guidelines. It insures mortgage loans from FHA-approved lenders against. These are expenses like mortgages car loans student loans credit card debt and more.

We use these terms when we communicate with lenders about VA-backed loans over 144000. Fannie Mae HomePath mortgage. 5500 5901 APR with 1125 discount points on a 60-day lock period for.

You must have satisfactory credit sufficient income to meet the expected monthly obligations and a valid Certificate of Eligibility COE. Kate Wood Sep 1 2022. You may have heard the terms additional entitlement bonus entitlement or tier 2 entitlement.

No-income no-asset loans have made a comeback but theyre only available for real estate investors buying rental properties. Many lenders look for no higher than 43 percent. 1 People who opt for VA loans usually do it because they cant qualify for a more traditional conventional loan.

Interest Rate Reduction Refinance Loan IRRRL. Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022. Check Your 0 Down Eligibility Today.

A hard pull can knock a few points off your score. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at 620. If youre interested in refinancing your mortgage to get a lower rate or achieve another financial goal check out our list of some of the best refinance lenders.

And keep in mind that regardless of the VAs loan limits your lender will limit your loan amount based on your credit score other debts and personal finance details. In general your credit score doesnt need to be high. The price of the home you want to insure must be within the loan limit for an FHA home in its location.

The FHA doesnt lend money to people. Many lenders will issue government-backed FHA and VA loans to borrowers with credit scores starting at 580. First time buyer September 1 2022.

Its possible for a home buyer with a credit score of 500 to get approved for an FHA loan but most FHA lenders look for scores of 580 or better. Claims that you can skip payments or get very low interest. Homeowner Tax Deductions.

VA loan limits no longer apply to first-time VA borrowers but they can apply if youre already using your VA loan benefit. Rocket Mortgage requires a minimum 580 credit score to qualify. Theyre not the most popular type of mortgage by any meansmaking up only 56 of all mortgages at the start of 2021.

Check Your 0 Down Eligibility Today. Check your credit report for errors and work with the credit bureaus to correct them. Check with your lender for more information.

The VA doesnt require a minimum credit score but most VA loan lenders do have a minimum requirement. We dont require a minimum credit score but some lenders may have different credit score requirements. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

No-income no-job no-asset mortgages dont require lenders to verify income assets or employment. However you can get refinance quotes from multiple. Fannie Mae HomePath.

This type of no-doc mortgage requires enough rental income to cover the new mortgage payment. VA Streamline Refi 2022 March 25 2022 FHA Streamline Refinance. VA Streamline Refi 2022 March 25 2022 FHA Streamline Refinance.

We help Veterans become Homeowners. How do I apply for an FHA loan. Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022.

If you have a VA home loan be careful when considering home loan refinance offers. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. Lenders may require downpayments for some borrowers using the VA home loan.

Some lenders even offer FHA loans with a credit score as low as 500 though this is far. VA IRRRL rates and guidelines. No downpayment required Note.

Terms and fees may vary so contact several lenders to check out your options. Renting your home after a VA refinance. Popular Articles How to buy a house with 0 down in 2022.

But lenders can also consider obligations that dont make your credit report like child-care costs alimony and even commuting expenses. How Does a VA Loan Work. The VA home loan is considered an.

The no-money-down USDA loan program typically requires a credit score of at least 640. Even VA lenders that allow lower credit scores. FHA loans have a 500 minimum median qualifying credit score.

However most FHA-approved lenders set their own credit limits. The VA mortgage was introduced as part of the GI Bill in 1944. And a FICO score of 580 lets you make the FHA.

You must qualify for a loan with an FHA-approved lender. However many VA mortgage lenders require minimum FICO scores of 620 or higher so apply with many lenders if your credit score might be an issue. During the title search the title company also looks for any outstanding mortgages liens judgments or unpaid taxes associated with the property as well as any restrictions easements leases or other issues that might impact ownershipThe title company may also require a property survey which determines the boundaries of the plot of land that a home sits on whether the.

See why more Veterans and military families chose Veterans United for their VA home purchase than any other lender in 2021. Its also important to know where your credit stands before you start looking for a home. When you refinance mortgage lenders check your credit report using a hard credit pull.

Your Guide To 2015 US. The IRRRL is a VA to VA loan. While lenders often approve down payments as low as 3 percent for.

Irrrl Lenders And Va Approved Refinance Lenders Irrrl Org

Irrrl Facts For Veterans Military Com

Va Interest Rate Reduction Refinance Loans Loan Officer Marketing Flyers

The Interest Rate Reduction Refinance Loan Or Irrrl Is One Of The Most Popular Va Refinance Options Amo Refinance Mortgage Refinance Loans Refinancing Mortgage

Va Streamline Refinance Irrrl No Income Or Assets Required Modern Lending Team

Va Streamline Refinance How It Works And When To Get One Fox Business

Minimum Credit Score For Va Irrrl 2022 Information

9 Best Va Mortgage Lenders For Streamline Refinance Irrrl Of 2022 Credible

Va Irrrl Program Home Refinance Quick Start Guide

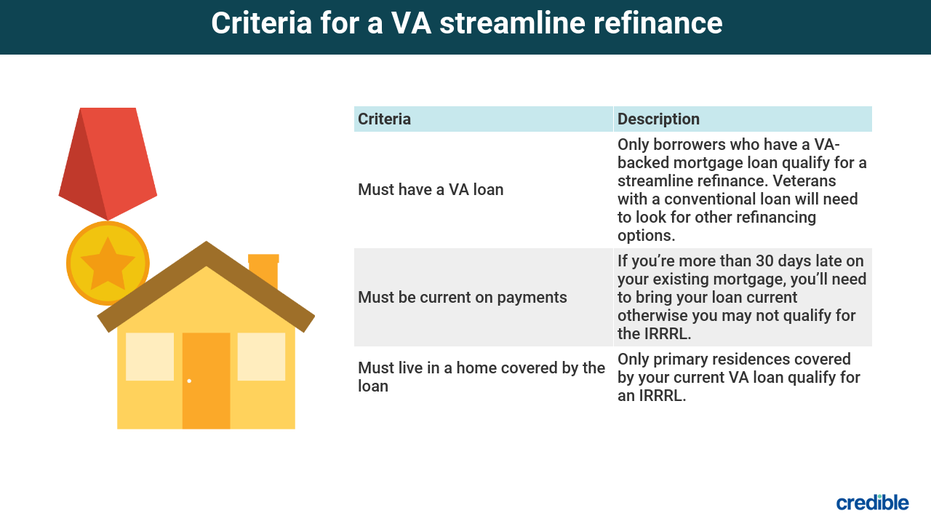

Va Irrrl Guidelines And Requirements Non Credit Qualifying Streamline

Va Irrrl Lenders Va Streamline Refinance Program Usa Home Financing

Best Irrrl Lenders What To Look For At Va Irrrl Lenders And Loans

Va Irrrl Program Super Fast Super Easy Super Helpful

Va Irrrl Document Checklist For A Smooth Loan Process Irrrl

Best Irrrl Lenders What To Look For At Va Irrrl Lenders And Loans

Does The Va Irrrl Require An Appraisal Irrrl

Can You Refinance More Than Once With Va Streamline Irrrl