37+ How much can i borrow first home loan

Use this calculator to calculate how expensive of a home you can afford if you have 37k in. Ad Compare The Best First Time Home Buyer Mortgages.

Anz 2 68 Fixed 2yr Home Loan Up To 3500 Refinance Rebate 0 3 Bundle Rebate Home Loans Investment Advice First Home Buyer

FHA calculators help you determine how much you can afford to safely borrow in order to finance your home.

. So a discount point for a home that costs 340000 is equal to 3400. See How Much You Can Save. Compare Now Save.

Ad Compare The Best First Time Home Buyer Mortgages. Finance Your Dream Home with the Lowest Rates. Get Instantly Matched with Your Ideal First Time Home Buyer Mortgage.

Get The Service You Deserve With The Mortgage Lender You Trust. 455 31 votes So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan. Get The Service You Deserve With The Mortgage Lender You Trust.

Get Started Now With Quicken Loans. Depending on the type of loan being used and other factors this limit is usually set somewhere in the 43 50 range. Top-Rated Mortgage Loans 2022.

Get Your Estimate Today. Ad Get the Best Mortgage Offers Compare Top Companies and Get Great Deals. Get Started Now With Quicken Loans.

So a third-year student will have more available federal loan funding than a second. If your home is worth 300000 the maximum you could borrow would be 80 of this240000. The comparison rate is based on a 150000 secured loan for a term of twenty five 25 years for all home loansWARNING.

Apply Online Get The Lowest Rates. Take the First Step Towards Your Dream Home See If You Qualify. Your credit score is one of the most important factors in determining how much you can borrow.

Conversely an HDB loan can cover up. Use them to determine the maximum monthly mortgage payment of principle and. Ad Compare Mortgage Loan Lender Offers for 2022 000 Federal Reserve Rate Top Choice.

However lets say that you currently owe 150000 on your first mortgage. The first step in buying a house is determining your budget. How Much Can I Borrow for My Home Loan.

The higher your credit score the better your chances of qualifying for a higher. Ad Compare Mortgage Options Get Quotes. The first thing to know is that federal loan limits increase as a student advances in school.

Lets use the 43 threshold as an example. Use this calculator to estimate the amount you can borrow. Understanding how much borrowing capacity you have when buying your first home is.

Fill in the entry fields and click on the View Report button to see a. Our mortgage calculator will give you an idea of how much you might be able to borrow. The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower.

Check Your Eligibility for a Low Down Payment FHA Loan. General purpose loans and primary residence loans. Discount points are paid upfront when you close on your loan.

If you take a bank loan the maximum amount you can borrow is 75 of your propertys price. This comparison rate is true only for the examples given and may. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

The question of How much can I borrow rears its ugly head for all new home buyers. A general purpose loan can be used for any purpose including buying or building a. How much can I borrow as a first-time buyer.

You can usually borrow as much as 80 or 85 of your. You may qualify for a loan amount ranging from 377030 conservative to 452436 aggressive. That means for a first-time home.

Apply Online Get The Lowest Rates. This mortgage calculator will show how much you can afford. Get Instantly Matched with Your Ideal First Time Home Buyer Mortgage.

There are two types of TSP loans. Ad Compare Mortgage Options Get Quotes. Simply put our mortgage calculator takes into consideration how much you.

Choose a Loan That Suits Your Needs. 1 discount point equals 1 of your mortgage amount. Compare Now Save.

The maximum amount you can borrow with a home equity loan depends on how much equity you have in your property. Get Your Estimate Today. To be eligible the lender.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. According to market research the average loan amount for first-time buyers is 176693. Ad First Time Home Buyers.

Your ability to borrow money will be determined by.

Heloc Infographic Heloc Commerce Bank Mortgage Advice

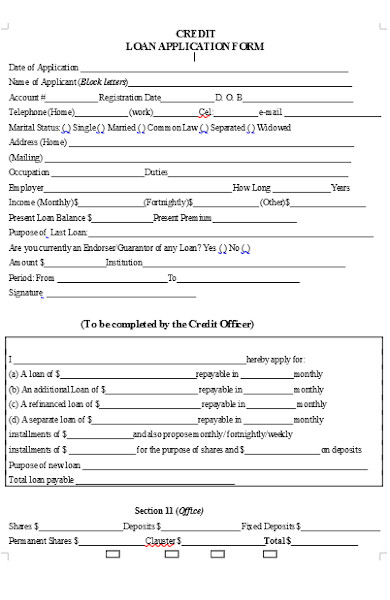

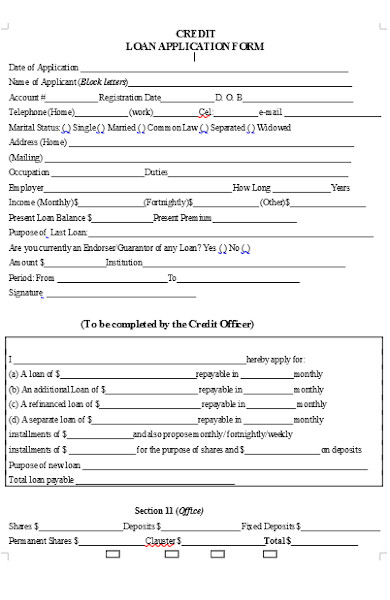

Free 55 Loan Forms In Pdf Ms Word Excel

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips

4id0gevyyh2ylm

Steps To Buying A House Home Buying Tips Home Buying Buying First Home

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Home Mortgage Refinance Mortgage

Tables To Calculate Loan Amortization Schedule Free Business Templates

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Are Some Financial Advisors Correct When They Say That Reverse Mortgages Are In General A Bad Idea Quora

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

5 Good Bad Habits Of A First Home Buyer First Home Buyer Buying First Home Buying Your First Home

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

Renting Vs Owning A Home Buying First Home Real Estate Tips Home Buying Tips

Get Home Loan In California Rcd Capital In 2022 Home Loans Refinance Loans Loan

30 Creative Financial Services Ad Examples For Your Inspiration Home Loans Banks Advertising Mortgage Loans